Fidelity’s Solutions to the Long-Term, Part-Time Provision

Information for Puerto Rico-Only Plans

The Setting Every Community Up for Retirement Enhancement Act of 2022 (SECURE 2.0 Act) expanded the long-term, part-time (LTPT) provision for part-time employees to include Employee Retirement Income Security Act (ERISA) 401(k) Puerto Rico-only plans. Beginning with plan year 2025, employees will be eligible to participate in an ERISA 401(k) Puerto Rico-only plan as a LTPT employee on the next entry date after completing two consecutive 12-month computation periods, with at least 500 hours of service but less than 1,000 hours of service in each period.

Fidelity’s Eligibility Tracking Service

Fidelity’s Eligibility Tracking service is updated to include LTPT employees who complete at least 500 hours of service in each 12-month eligibility service computation period over two consecutive years. Only hours of service for plan years beginning after December 31, 2022, are considered, meaning all hours of service for computation periods before 2023 are excluded.

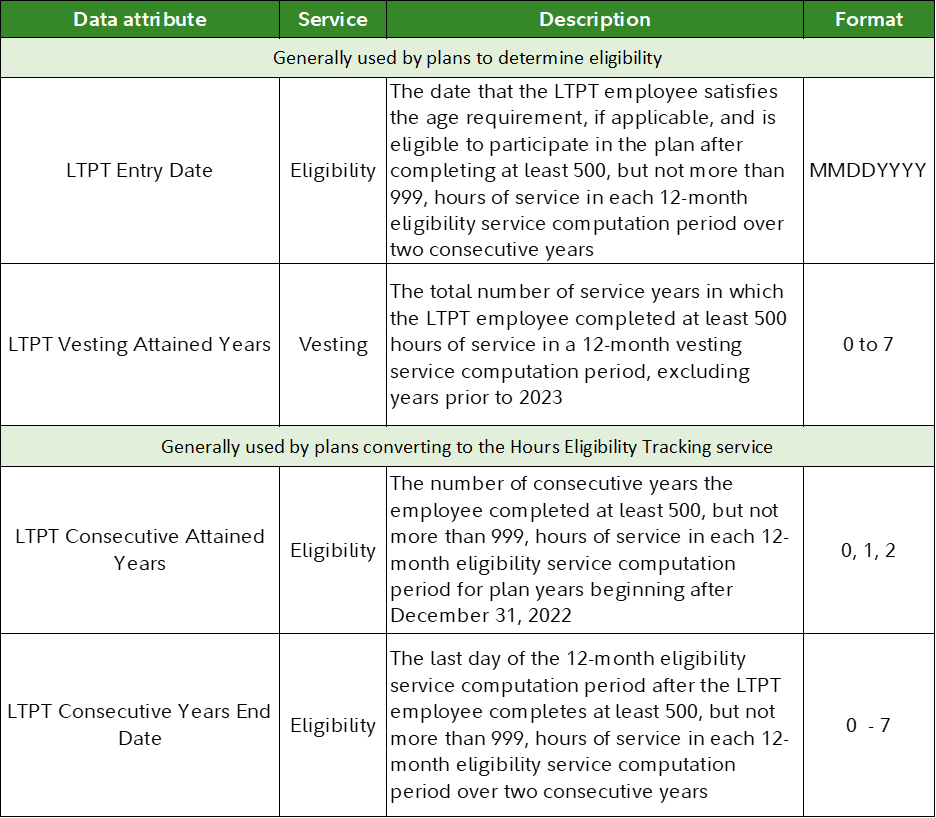

Plan sponsors determining eligibility for their LTPT employees should review their procedures and/or consult with their payroll provider to identify the impact of the new provision. Payroll providers currently sending Fidelity eligibility information for full-time employees should continue this practice. Additionally, new LTPT employee information may be required to be sent to Fidelity. The applicable data required to be submitted to Fidelity is identified in the table below.

Note: Employee eligibility data will be required when an employee satisfies the service requirement for:

- At least 500 but less than 1,000 service hours in each of two consecutive years, and if the employee later satisfies

- 1,000 service hours in one year

Employer Contributions

The LTPT employee provision allows plan sponsors to include or exclude LTPT employees from receiving employer contributions. Fidelity’s best practice is to exclude LTPT employees from receiving any employer contributions unless directed otherwise.

Plan sponsors using Fidelity’s Employer Contribution Calculation service will need to provide us with direction to make changes to their current employer contribution calculation for their LTPT employees if they choose to include LTPT participants. Please contact your Fidelity representative to discuss this further and determine if any changes will be required.

Plan sponsors calculating their own employer contributions should review their procedures to determine the impact of the LTPT employee provision on their calculation and discuss this with their payroll provider.

NetBenefits® has been updated to reflect generic participant information based on plan design.

Vesting

Fidelity Vesting service (actual hours of service) is being updated to review an employee’s service history once they satisfy the LTPT eligibility provision. All years of service in which the employee completes at least 500 hours of service in a vesting computation period will be counted, excluding years prior to 2023. The plan may also be required to send a new LTPT Employee Attained Years value, when applicable. The data requirements are identified in the table below. Additional data elements may be required for other vesting methods.

New LTPT Employee Date Requirements

Eligibility and Vesting Data Elements

Four new data elements have been added to support the LTPT employee provision to identify an employee’s eligibility, entry, and vesting dates.

In addition, an eligibility date must be provided to Fidelity when an employee satisfies the LTPT rule, then later satisfies the standard eligibility rule (1,000 service hours in one year).

Sending Data to Fidelity

The following traditional channels will continue to support the new LTPT employee data elements:

- Electronic Data Transmission

- Plan Sponsor WebStation® — File Upload*

- Plan Sponsor WebStation — Participant Overview—Employment Information tab*

*Channel availability will vary. Please contact your Fidelity representative to learn more.

Employee Communication and Enrollment Material

Plan sponsors have the option to include or exclude LTPT employees from their employer contributions. Fidelity’s best practice is to exclude LTPT employees from receiving employer contributions unless directed otherwise.

LTPT employees will continue to receive timely enrollment and plan communication material. The material may currently reference that an employer contribution is available to all eligible employees or only certain groups of employees, before the LTPT employee provision’s effective date. Please contact your Fidelity representative to discuss this further and determine if any changes to enrollment materials will be required.

Testing Services

Under the LTPT employee provision, plan sponsors can elect to include or exclude LTPT employees from nondiscrimination testing. Fidelity’s best practice is to exclude LTPT employees unless directed otherwise by the plan sponsor.

Our testing group will use the LTPT employee data stored on Fidelity’s recordkeeping system for plans using Fidelity’s Eligibility Tracking service. Plan sponsors determining their own LTPT employee eligibility must provide the employee eligibility data to Fidelity in a timely manner when testing is performed by Fidelity.

Plan Sponsor WebStation Reporting

The new LTPT employee data elements were added to Plan Sponsor WebStation under the “Create Reports” section. You may create the relevant reports at your discretion. A Fidelity standard report identifying LTPT employees is also available.

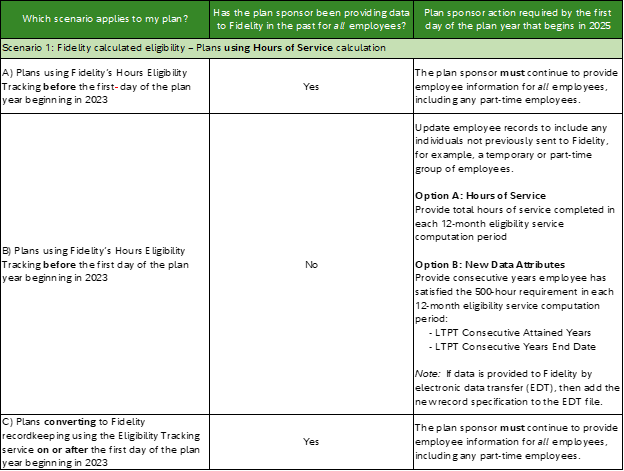

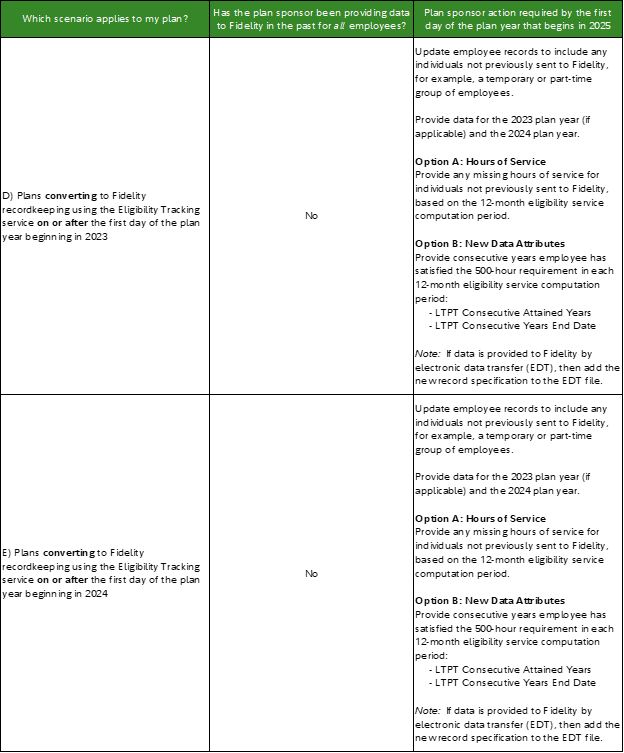

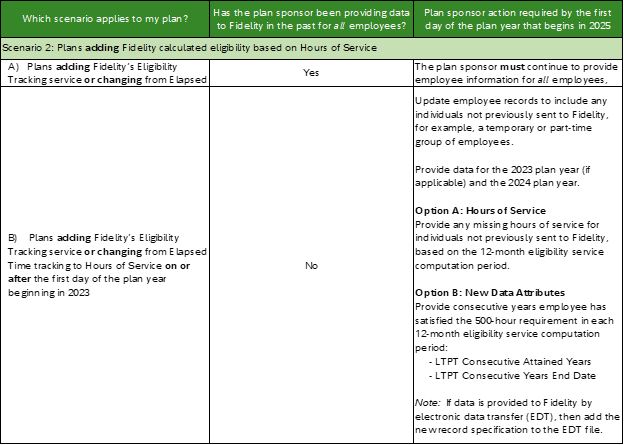

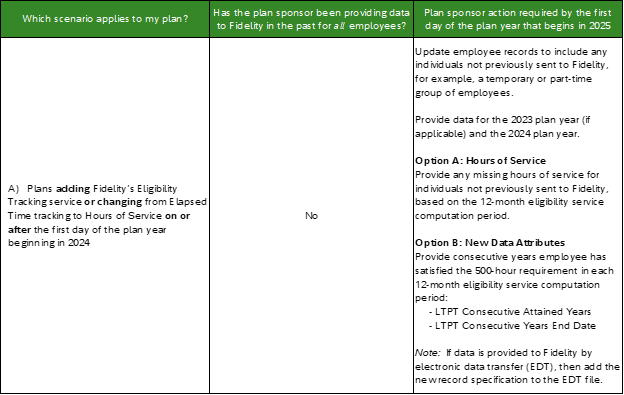

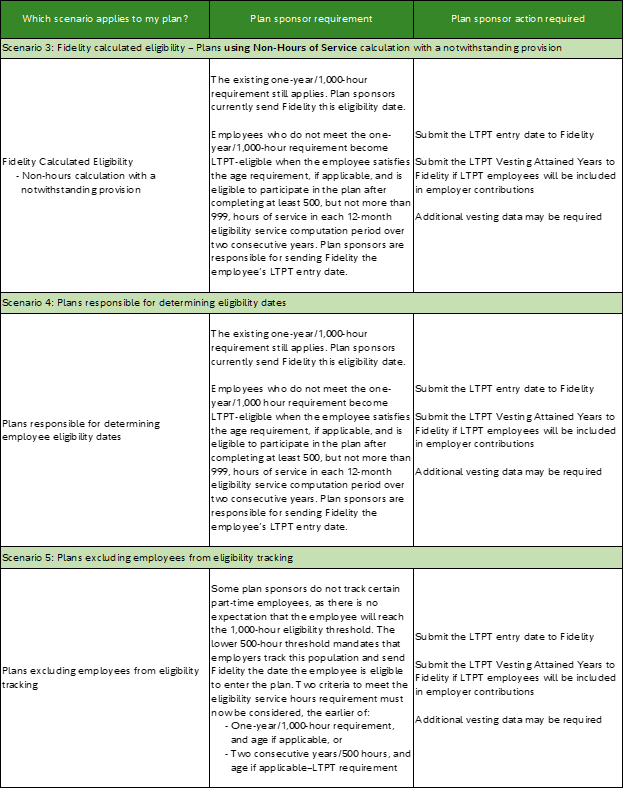

Scenarios

Plan sponsors with plans that use hours of service to determine eligibility for some or all of their employees must timely provide Fidelity with the relevant information to identify those employees who are LTPT employees and eligible to participate in the 401(k) portion of the plan.

Please locate the scenario applicable to your plan in the matrix below.

Plan Sponsor Next Steps

Consider the impact on your plan from the long-term, part -time provision and solution details provided above.

| The impact of LTPT on your employee population Inclusion or exclusion of LTPT employees in employer contributions and testing Data requirements, sharing data with Fidelity, or managing data internally | With your legal counsel for assistance if you are uncertain if your plan document currently excludes employee groups that may be subject to the LTPT employee requirements in the future | Your Fidelity representative to share your LTPT decisions and discuss activities to ensure compliance with the new provision |