Disability Community Page

These tools and resources help foster an inclusive environment where every employee can make progress on their financial future with confidence.

|

|

|

|

|

Every year since 2018, Fidelity has received a top score on the Disability Equality Index, which has become the leading independent, third-party resource for the annual benchmarking of corporate disability inclusion policies and programs.2 |

Community Overview

Meeting everyone where they are

|

We remain committed to creating a disability inclusive environment for our customers and employees alike. From digital accessibility programs and ASL interpreters to accounts for disability-related expenses, learn some of the ways Fidelity supports diverse needs. |

Exploring financial priorities within the disability community

Disability: The most inclusive minority group

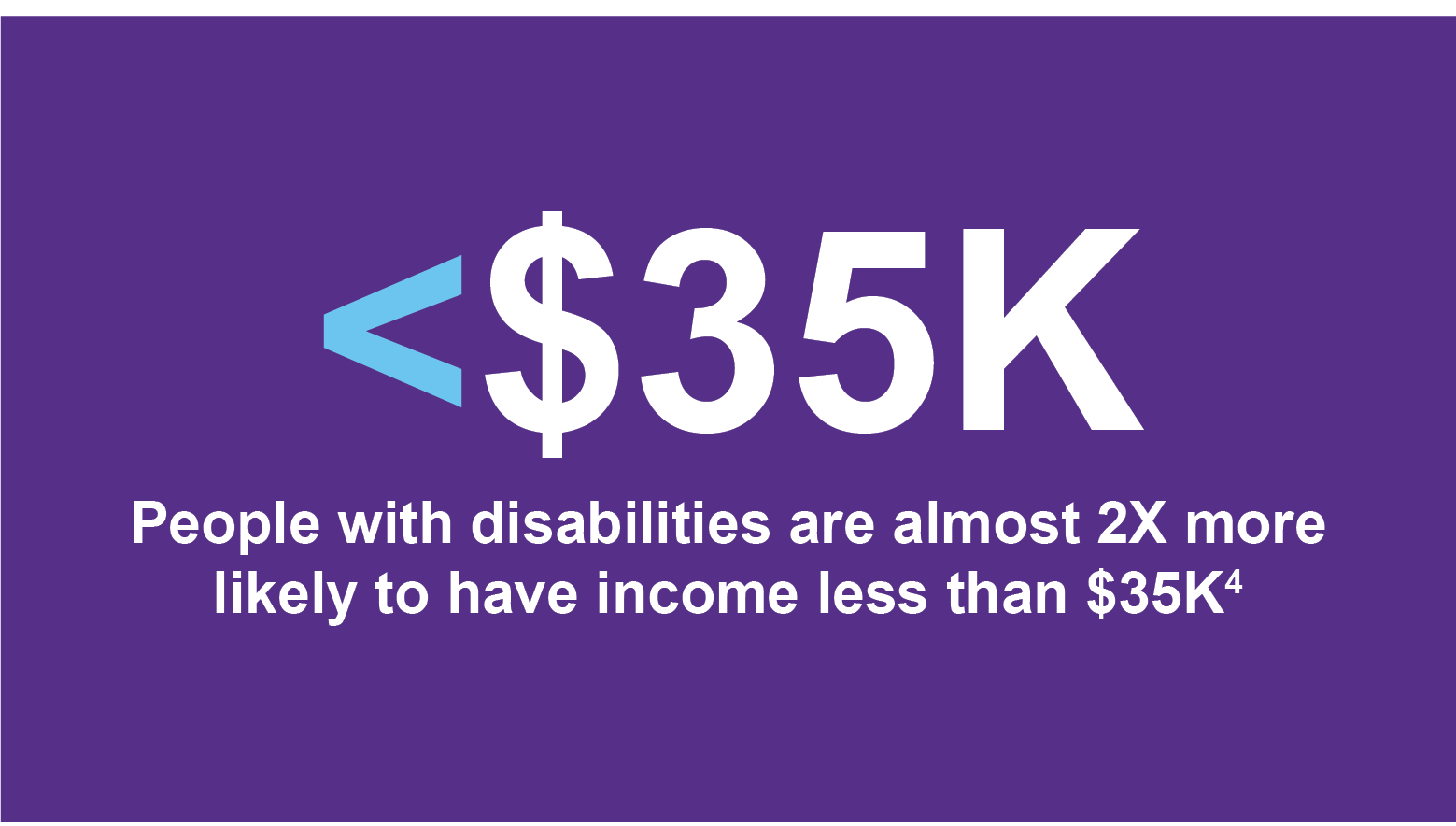

In the U.S., 1 in 4 people report having a disability.1 However, not all disabilities are visible—70% are invisible. While the Americans with Disabilities Act, passed in 1990, helped increase disability representation in the workforce,3 there are still challenges and unique planning considerations that arise for the disability community. A report published in partnership with the National Disability Institute and The Harkin Institute found that “people with disabilities are far less likely to be financially healthy than those without disabilities.”4

|

|

What this means for employers

Between February 2020 and August 2023, the number of employed Americans with disabilities soared by 33%.5 Flexible work environments during the pandemic, as well as factors like advancements in technology, have contributed to the surge in disability participation in the workforce.6 Now there’s a greater need for financial education. By recognizing and addressing the complex challenges faced by your team members with visible and invisible disabilities, you can help them feel more confident about their financial well-being and get on the path toward reaching their money goals.

The “disability tax”

$17,690. That’s the additional income needed on average by households that have an individual with a disability to maintain a similar standard of living to those without.7 Expenses including healthcare, home and vehicle modifications, adaptive equipment (i.e., wheelchairs), and assistive technology (i.e., screen readers) can leave many feeling stretched thin while trying to juggle other money priorities. Other indirect costs also play a role, with an increase in care needs or medical leave leading to a loss of household wages.

What this means for employers

People with disabilities are almost 3 times more likely to have extreme difficulty paying bills and are also more likely to be unable to come up with $2,000 if an unexpected need arose.8 You can help by providing accessible and relevant resources that can help them navigate benefits options and plan for the future. For instance, specialized accounts like ABLE accounts allow individuals with disabilities and their families to save in a taxadvantaged account while keeping benefits such as Supplemental Security Income and Medicaid. There are also other Fidelity experiences, like Goal Booster, that can guide them in the path toward achieving short-term goals such as building emergency savings.

Disability Toolkit Resources

Download and use the following materials to drive awareness and engagement with your team.

Helpful Resources

|

|

|

| Addressing the unique financial priorities of tomorrow’s workforce | Empowering your organization through disability inclusion | Helping employees save for emergencies |

Disability Community Zone

Support your team members with disabilities even more. Find videos, info about accessible services, and articles to help your employees navigate the realities and expenses of living with a disability while feeling more confident about making the most of their money at the Disability Community Page.

See how the ASL sign for Fidelity Investments came to be.

References:

- Centers for Disease Control: Disability & Health Data Systems, 2023.

- Disability Equality Index Report 2018 and 2024. Disability:IN.

- Center for Disease Control: 40 Eye Opening Disability Statistics to know in 2024.

- https://finhealthnetwork.org/research/the-financial-health-of-people-with-disabilities/

- https://www.nationaldisabilityinstitute.org/wp-content/uploads/2018/12/finra-infographic.pdf

- “Career Opportunities for Americans with Disabilities Are on the Rise Following the COVID-19 Pandemic,” Progressive Policy Institute, 11/28/2023.

- “The Extra Costs of Living with a Disability in the U.S.—Resetting the Policy Table,” National Disability Institute, October, 2020.

- https://www.nationaldisabilityinstitute.org/wp-content/uploads/2018/12/finra-infographic.pdf